C. Thomas Wilson/Of Counsel

Areas of Practice: Business + Corporate, Estates + Trusts, Real Estate

Office Location: Minneapolis, Minnesota

Direct: 612.336.9317 / Email: twilson@lommen.com

C. Thomas Wilson / Biography

Tom Wilson offers extensive experience in meeting the legal needs of businesses and individuals in business, estate planning and real estate. He has been a frequent lecturer for legal education and other seminars and an active board member for several organizations when he practiced in New Ulm for over 40 years.

Tom has a broad-ranging practice which includes the formation, operation, acquisition and merger of business partnerships of every description, as well as small and closely held corporations. He specializes in creating and administering trusts and sophisticated estate planning for individuals, and maintains a substantial real estate practice.

Education

- University of Minnesota, B.A., 1970

- William Mitchell College of Law, J.D., 1975

Bar Admissions

- Minnesota, 1975

News + Articles

With tax changes, do I still need estate planning?

When people think about estate planning, the estate tax is one of the first things that comes to mind. The Tax Cuts and Jobs Act signed into law by President Trump on December 22, 2017 brought significant changes to the transfer of wealth, including increasing the...

How the New Tax Law Will Affect Divorce Payments

Late last year, Congress and the President enacted sweeping new tax legislation that fundamentally affects the family both during marriage and following divorce. The Tax Cuts & Jobs Act (“TCJA”) made four key changes of which you should be immediately aware....

Trusts 101

Cameron Kelly and Jesse Beier spoke with Steve Sorenson at an NBI seminar, Trusts 101, on June 18, 2018 in Eau Claire, Wisconsin. Program Description Provide your clients with the full spectrum of wealth preservation options. When assessing complex information,...

Probate and Estate Planning Fundamentals

Cameron Kelly and Jesse Beier presented at the Hudson Daybreak Rotary on March 7, 2018 on "Probate and Estate Planning Fundamentals."

New Tax Act Slices Deduction for Payments and Fees on Confidential Sexual Harassment or Abuse Settlements

A deep look into the new Tax Act reveals a significant change in existing law regarding the deductibility of confidential sexual harassment settlement payments and attorney’s fees. Previously, settlement payments (for defendants) and the attorney’s fees necessary to...

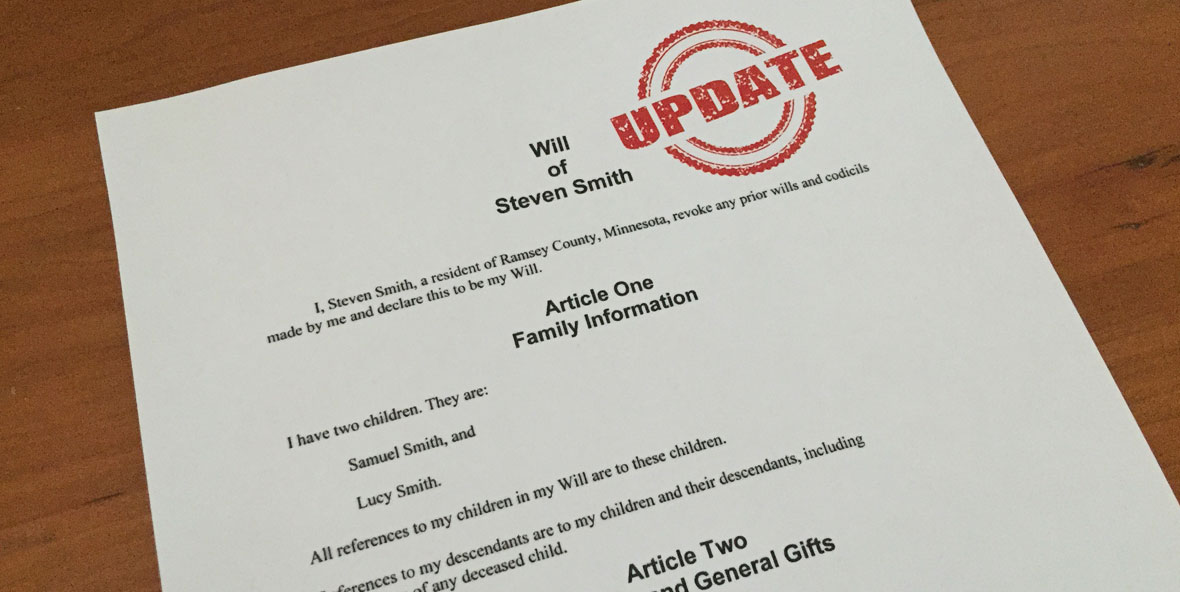

When Should I Update My Estate Plan?

I recently worked with a client after his spouse passed away. Their revocable living trust had been drafted in 2000 by a competent attorney. At that time, the federal estate tax exemption was $675,000. The estate tax exemption is the amount of money that a person...