Federal Estate and Gift Tax Exemption: The IRS announced the official estate and gift tax limits for 2019 late in November of 2018. The federal estate/gift tax exemptions for an individual increases to $11.4 million, up from $11.18 million in 2018. This means an...

Can the State of Minnesota Tax Your Trust?

Minnesota income taxes are currently among the highest in the nation, which is why many of our estate planning clients prefer to create trusts that will be taxed in other states. Many of these other states, such as South Dakota, have no income taxation, and favorable...

Substitute Parent: What to Consider When Choosing a Guardian

I spend a lot of time talking to clients about property, but at its core estate planning is about family. Clients want to ensure that their family will be taken care of. For parents of young children, the most important family decision is the selection of a guardian....

Cameron Kelly Completes LL.M. Degree in Estate Planning

Cameron Kelly recently completed his LL.M. Degree in Estate Planning, graduating with honors from the John Marshall Law School. His coursework focused on the taxation of estates, protecting estate assets, and business succession planning. Cameron’s degree will allow...

With tax changes, do I still need estate planning?

When people think about estate planning, the estate tax is one of the first things that comes to mind. The Tax Cuts and Jobs Act signed into law by President Trump on December 22, 2017 brought significant changes to the transfer of wealth, including increasing the...

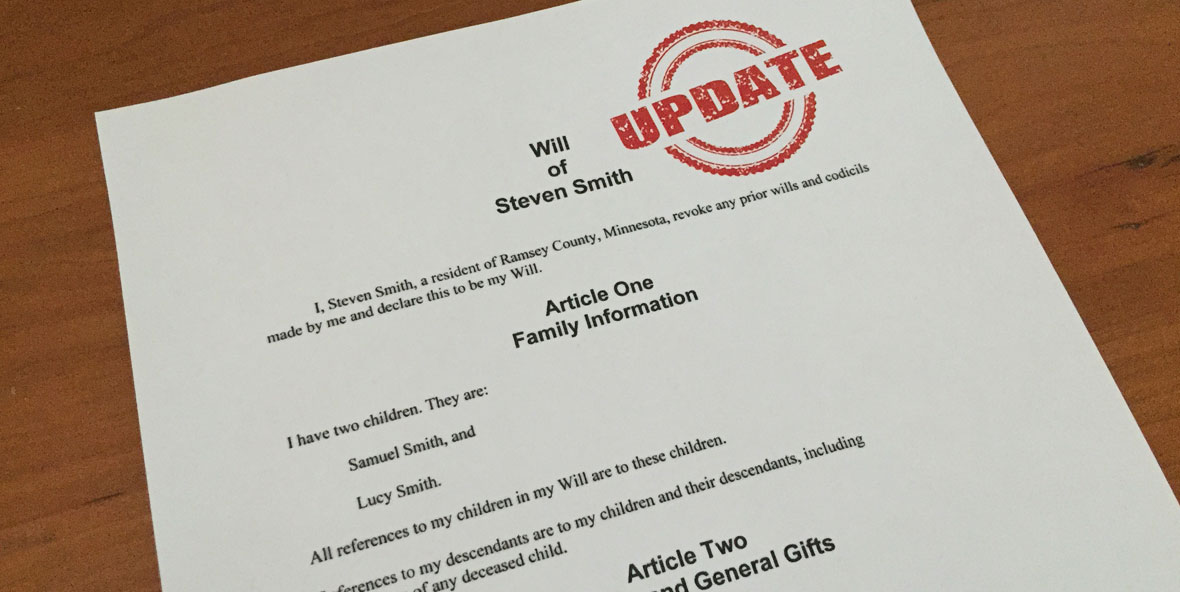

When Should I Update My Estate Plan?

I recently worked with a client after his spouse passed away. Their revocable living trust had been drafted in 2000 by a competent attorney. At that time, the federal estate tax exemption was $675,000. The estate tax exemption is the amount of money that a person...

Estate Planning: Check Things Twice Before Moving on to 2018 Resolutions

Estate planning may not be at the top of most people's minds during the holidays. But it is important to check things twice before moving on to 2018 New Year's resolutions. For many of us, this includes updating our estate plans, figuring out what's happening with...

2017 Estate Tax Update

From comprehensive tax reform making its way through congress, to the changes to the Minnesota estate tax, it has been an eventful year for estate planning. While tax changes are not the most exciting topic for many of our clients, it is a topic that continues to be...

Taking a Last Minute Distribution From Your IRA? Consider a Qualified Charitable Distribution

Most of our clients have at least a portion of their savings in IRAs. Those that do not often have savings in a 401k, which will likely be converted to an IRA upon retirement. Both 401k and IRA plans allow a person to put money away tax free. However, when money is...

2017 Snowbird Update

There have been significant well publicized estate planning legislative updates in 2017, including the increase in the Minnesota estate tax exemption amount and the proposed repeal of the federal exemption. Two lesser-known changes impact one of Minnesota’s most...

2017 Year-End Estate Planning Checklist

As the end of the year approaches and with the holiday season in full swing, estate planning isn’t typically at the top of most people’s wish lists. Nevertheless, it is important not to move on to 2018 new year’s resolutions without tying up the loose ends from the...

Guardianship

There is often confusion regarding what a guardianship is and whether it may be necessary for a friend or loved one. This article is meant to provide a general overview of guardianships in Minnesota. A guardianship is a relationship between a guardian, who is...

Four Things to Consider About Do-it-Yourself Estate Planning Software

As a price conscious homeowner, I am all for do-it-yourself projects to save a few dollars here and there. I often bite off more than I can chew, like the time I thought I could handle rerouting the plumbing in a bathroom. Predictably, this resulted in a flooded...

Minnesota Estate Tax Legislative Update – May 2017

Governor Dayton has signed the 2017 tax bill which will increase the Minnesota estate tax exemption from its current level of $1.8 million to $2.1 million for individuals dying in 2017. The legislation also adjusts the estate tax exemption in subsequent years;...

Adding new estate planning resources to meet client needs

Cameron Kelly, a Stillwater attorney practicing in the areas of estate planning, business law and real estate, joined Lommen Abdo May 15th. Cameron is a certified real estate specialist and is on the 2017 list of Minnesota Rising Stars as published by Super Lawyers. ...

Lommen Abdo Strengthens its Estate Planning and Corporate Practices

Cameron Kelly, an estate planning and corporate attorney, joined Lommen Abdo this month. Cameron Kelly enjoys providing high quality planning for individuals and businesses. His practice includes assisting clients with comprehensive estate planning, including wills,...

How to protect your children’s inheritance from divorce, creditors, and lawsuits

As divorce rates rise and society becomes increasingly litigious, asset protection has become an increasingly important aspect of estate planning. While most people understand the more common estate planning goals such as probate avoidance and limiting estate tax...

Five tips for updating your estate plan during or after divorce

Divorce is a difficult process, no matter how amicable the split. Between property division, potential custody disputes, and escalating legal bills, no one wants to think about more legal hoops to jump through. While updating your estate plan during a divorce may be...

The Right Choice

Do you have a legal question? Contact us today. We are here to help you!