A recent U.S. Supreme Court ruling assures that Minnesota’s revocation-on-divorce statute will operate to revoke all pre-divorce beneficiary designations to the ex-spouse, even on insurance policies entered into before the enactment of the Uniform Probate Code (UPC)....

Autonomous Vehicles: Threat or Opportunity

Let’s face it, our industry has been slow to adapt in the technology revolution we find ourselves in today. We operate in a capital-intensive, low-margin, fragmented industry, with a low barrier to entrance. Large and small carriers have been able to co-exist through...

Substitute Parent: What to Consider When Choosing a Guardian

I spend a lot of time talking to clients about property, but at its core estate planning is about family. Clients want to ensure that their family will be taken care of. For parents of young children, the most important family decision is the selection of a guardian....

Marc Johannsen Honored by Boy Scouts of America

Marc Johannsen recently was recognized by the Northern Star Council of the Boy Scouts of America for his volunteer work when he was awarded the Silver Beaver Award. This nomination-only award is the highest award a council can bestow upon a volunteer and recognizes...

Cameron Kelly Completes LL.M. Degree in Estate Planning

Cameron Kelly recently completed his LL.M. Degree in Estate Planning, graduating with honors from the John Marshall Law School. His coursework focused on the taxation of estates, protecting estate assets, and business succession planning. Cameron’s degree will allow...

Parents Eligible for 2017 Wisconsin Child Tax Rebate and Sales Tax Holiday – Act Now!

Wisconsin families are now able to sign up for a one-time $100-per-child tax rebate, set to correspond with a back-to-school sales tax holiday. Legislation signed by Governor Walker in April created a tax rebate for Wisconsin sales and use tax paid on purchases made...

Drilling Down: The Vaccine Act

The National Childhood Vaccine Injury Compensation Act of 1986 (“Vaccine Act”), 42 U.S.C.A. § 300aa-11 et seq., established a streamlined, no-fault compensation method for injured vaccine recipients to recover compensation. Under the Vaccine Act, a no-fault program...

North Dakota Supreme Court Sheds Light on Significant Consequences Unlicensed Contractors May Face

In Snider v. Dickinson Elks Building, LLC, 907 N.W.2d 397 (ND 2018), the North Dakota Supreme Court clarified the consequences contractors engaged in the business of construction, repair, alteration or demolition can face if they don’t obtain a license before...

Electronic Logging Devices: A Hacker’s New Window to Your World?

Electronic Logging Devices (“ELD”) are now required for drivers of many commercial motor vehicles (“CMV”) in the United States. ELDs are the electronic equivalent of a paper log used to record a driver’s working and driving time. The new mandate will result in...

Lommen Abdo voted a finalist in the “2018 Best Law Firms of the St. Croix Valley”!

Lommen Abdo was voted as one of the finalists in the "2018 Best Law Firms of the St. Croix Valley"! Thanks for your vote. What was it about the Lommen Abdo Law Firm you really like? Our business practice? Our family law practice? Our trial and appellate lawyers? Our...

With tax changes, do I still need estate planning?

When people think about estate planning, the estate tax is one of the first things that comes to mind. The Tax Cuts and Jobs Act signed into law by President Trump on December 22, 2017 brought significant changes to the transfer of wealth, including increasing the...

How the New Tax Law Will Affect Divorce Payments

Late last year, Congress and the President enacted sweeping new tax legislation that fundamentally affects the family both during marriage and following divorce. The Tax Cuts & Jobs Act (“TCJA”) made four key changes of which you should be immediately aware....

New Tax Act Slices Deduction for Payments and Fees on Confidential Sexual Harassment or Abuse Settlements

A deep look into the new Tax Act reveals a significant change in existing law regarding the deductibility of confidential sexual harassment settlement payments and attorney’s fees. Previously, settlement payments (for defendants) and the attorney’s fees necessary to...

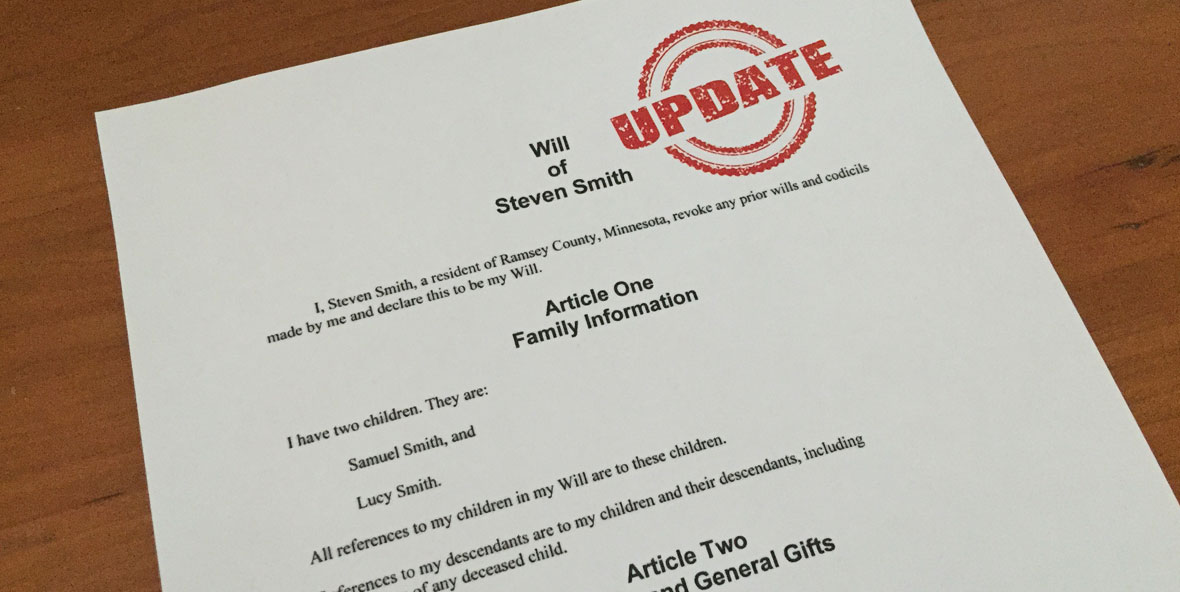

When Should I Update My Estate Plan?

I recently worked with a client after his spouse passed away. Their revocable living trust had been drafted in 2000 by a competent attorney. At that time, the federal estate tax exemption was $675,000. The estate tax exemption is the amount of money that a person...

Technological Literacy: The New Normal for Legal Practice

The Minnesota Rules of Professional Conduct now require a lawyer to maintain technological literacy in legal practice. Such technological literacy is critical because lawyers are attractive, and increasingly frequent, targets of cyber criminals. To develop...

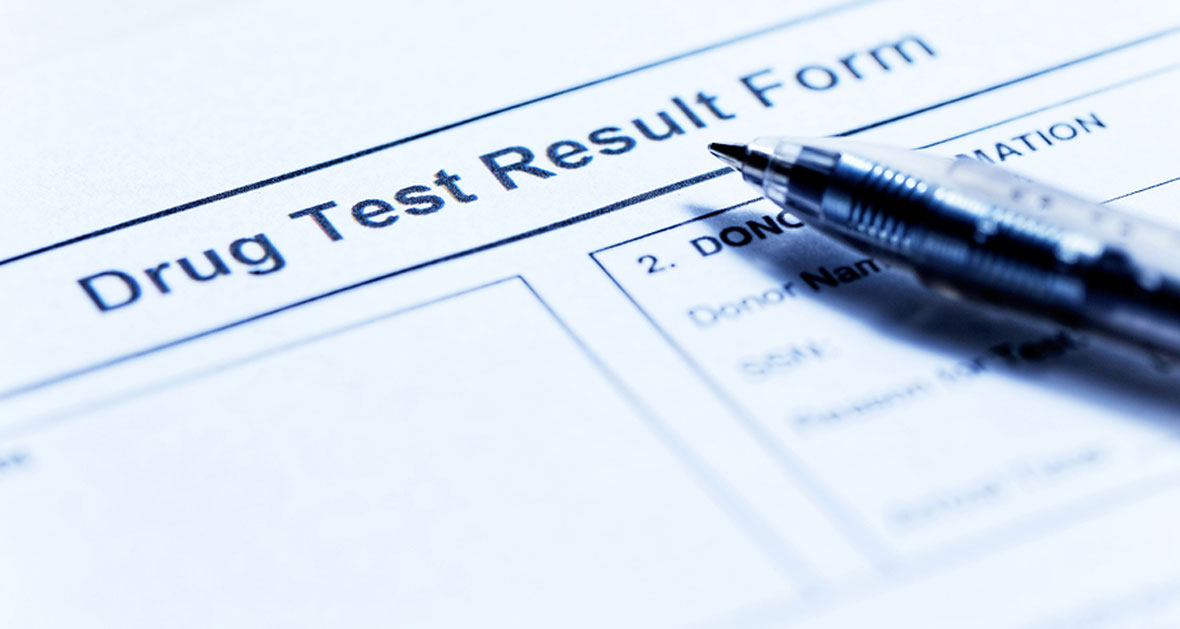

Department of Transportation Revised Employee Drug Testing Rules Effective January 1, 2018

On January 1, 2018, commercial motor vehicle drivers and those performing safety sensitive functions for cargo and passenger carriers (collectively “drivers”) regulated by the United States Department of Transportation (DOT) will now be screened for four additional...

Motor Carriers and New Electronic Logging Device Regulations

For businesses involved in the interstate transportation of goods by truck, December 2017 brings an important change – into the electronic age – as to how drivers must keep track of their working hours. For many decades the federal government limited the number hours...

Estate Planning: Check Things Twice Before Moving on to 2018 Resolutions

Estate planning may not be at the top of most people's minds during the holidays. But it is important to check things twice before moving on to 2018 New Year's resolutions. For many of us, this includes updating our estate plans, figuring out what's happening with...

The Right Choice

Do you have a legal question? Contact us today. We are here to help you!